← Trump: A man of the people? We’ll wait and see

Money Transformation Day of Ritual – Part III

Jacqui Haigh as Melusine in Daisy Campbell’s revue, 23rd October 2016

Before we continue with our tale, let’s remind ourselves of why we are here.

Why have a bunch of strangers met on the streets of London, on a blustery cold November day, to act out a series of rituals which, to the public at large, would look like nothing more than New Age gobbledegook?

So let’s look at the issues.

In 2007-2008 there was a banking crisis. We’ll start there as this is the most recent and obvious indication of what might be wrong with our world.

The banks had been raking in the money for years, and growing obscenely rich, but, what we didn’t know, is that they’d been engaging in major fraud to do this. Yes, that’s right: fraud. Fraud on a massive, industrial, transnational scale: selling fraudulent mortgages to people who couldn’t afford it in the United States (so called “liars loans”) then disguising these loans as secure bonds by slicing them up and repackaging them in complex financial instruments known as derivatives, which were then sold on the open market: to pension funds and local governments and other investors, large and small, around the world.

The rating agencies, whose job it is to test financial products and grade them according to risk, were giving out triple A ratings to these derivatives; to what were, in effect, doomed investments. They were doing this because their business was so inextricably tied to the fortune of the banks that they daren’t question what was going on.

The whole business model was riven by fraud, from the bottom to the top, and the CEOs of the large banks, who were leading this process, were becoming rich beyond measure.

And then, one day, the whole system ground to a halt. Banks stopped lending to each other, and the whole economic system was teetering on the brink of total collapse. It was then that “we the people” showed up. We the people, meaning governments world wide, were forced to hand over trillions of dollars in public money in order to keep the banks from imploding, because, we were told, these banks were “too big to fail”. If they collapsed, then the whole system would collapse with them.

Fraud, remember. Fraud on a grand scale. Fraud on a scale never seen in the world before. And not one banker was gaoled for it. Not only was no one gaoled, they were rewarded for their efforts, paying themselves massive bonus’ using the public funds that had only recently been handed over, and pocketing it themselves. After which, it was business as usual; except that the huge liabilities that the banks had created by their fraudulent practices, were now dumped upon the shoulders of the public to bear, while they went on doing exactly what they had been doing before, getting richer by the minute.

That’s the world we live in now: a world where fraud is rewarded, and the savings of billions of people are compromised, in order to keep the system ticking over.

At the heart of all of this lies the question of money-creation. Where does money come from? How is it created? Who brings it into being and how?

This is where most people get confused. It’s not a question that is asked very often. People think that money is just there somehow. The government creates it, by printing it: isn’t that how it’s done?

Well yes. That’s how it is done. That’s the stuff you carry round in your pocket; but that only accounts for about 3% of the money in circulation. The rest of it is electronic money, that exists as numbers in computers all over the world, and this money isn’t printed at all. It is magicked into being by the banks.

When you go to a bank and ask for a loan, where does that money come from? Do they go downstairs into a vault, and lift a great big wad of fivers they had stored down there, in order to lug it back upstairs to hand it over to you? Of course not. They just tap the number into your account, and you agree to pay it back. But what you believe is that the money has some kind of existence somewhere. They are lending you something they hold. But this is the really startling thing, the really mind-boggling thing. They don’t. They don’t hold anything. That money you have agreed to pay back never had any kind of existence anywhere in the world until the moment you signed the contract agreeing to pay it back.

If anything has the right to be called “magic” in this world, surely it is this?

Money from nothing, conjured out of thin air, abracadabraed into existence by the simple expedient of tapping a few numbers into a computer.

This is the big secret that lies at the heart of the banking system. It’s called “fractional reserve banking”. Banks lend out many times more than they hold as savings. Many, many, many times more. Part of the fraud in the banking crisis was that, in some cases, banks held virtually no reserves at all. All the money they held had been leveraged and leveraged so many times it no longer had any kind of substance or reality. It was homoeopathic money: money so watered down as to have no real existence any more. It was only the fact that we all still believed in it that kept the system going. As long as we didn’t all turn up at the bank at the same time asking for our money back, they could get away with it: they could get away with lending money that didn’t exist and then charging interest on it.

It’s called “confidence”. As long as we have confidence in the banks, the banks will continue to thrive.

And therein lies the key. “Confidence”. Like a confidence trickster: a con merchant, a con artist. The con artist gains your confidence by some little act of trust, by making it appear that you will make some gain, after which they betray that confidence, and take you for every penny you’ve got.

This is exactly what happened in 2007. You were conned. I was was conned. We were all conned. But the confidence trickster, in the form of the private banking system, has been left in place to continue with his egregious abuses of public confidence.

But there’s another element to this. If banks can conjure money out of thin air, why can’t we?

Well we can. That is the other option. It’s called public banking.

We’ve been sold a narrative, a story. The story goes like this. A country is like a household. It has to live within its means. So, like a household, it has to go to the bank to borrow money when it runs short. Currently we owe lots of money to the banks, so, in order to live within our means, and pay back what we owe, we now have to “tighten our belts”. That’s called austerity. We have to give away our benefits, take a cut in wages, sell off our public assets, and allow private enterprise to run the world for us instead.

But a country is nothing like a household. It is much more like a bank. And, like a bank, it can magic money into existence. It can create money out of thin air. In fact the sheer absurdity of the story we’ve been sold is illustrated by the process known as “Quantitative Easing”. Quantitative Easing is money created out of thin air by the Bank of England which is then given to the private banks, so that they will lend it back to us.

Are you pulling your hair out yet? Are you screaming with frustration? Why are we having anything more to do with these con merchants? Why don’t we just create the money ourselves and then spend it into the economy, making us all better off? Quantitative Easing for the people. It’s been done before.

Just to give you one example: Abraham Lincoln issued his own money in the form of greenbacks during the American Civil War, which were not only used to pay for the conflict, but for large infrastructure projects too, including the United States’ intercontinental railway system, still in use to this day. Such is the conjuring power of money that it can fund gigantic projects that will go on to have centuries of use.

You are probably wondering what a bunch of magical folk engaging in public ritual have to do with any of this? But that’s the point. The processes by which money can be called into being and then stored and accumulated, is itself a form of magic. It is invisible, conceptual, with so little existence on the physical plain as to appear almost non-existent. Most of the money is the world is stored as numbers in computers, nothing more, electronic blips on a computer screen, and it is only our collective confidence in the system that maintains it. It is belief, in other words, faith: the same means by which religious systems are kept functioning; and just as religion needs its theologians to help justify its claims, so the money-god needs economists.

Religion is something that exists mainly in people’s heads, as does money. As does magic too, of course.

All of them are deeply tied into the human imagination. But whereas money and God appear to exist outside of us, as forces that own and control us, magic is the means by which we can reclaim imagination for ourselves.

Magic is the application of practical imagination in the world.

It is the collective conjuring up of forces that, instead of controlling us, we can control.

It is at this point, perhaps, that we may return to our tale: a bunch of people hanging round by Wellington’s statue, having just planted our money-sigil into the Bank of England.

This is the moment that Jacqueline Haigh appeared to the crowd in the form of Melusine, the double-tailed mermaid, Jonathan Harris’ recently divined symbol of money.

Jacqui Haigh as Melusine outside the Royal Exchange

I’d met Melusine a few times before. On our last reconnaissance mission Jon and I had gone into the Bank of England museum where he’d shown me a treasure chest where they’d kept the money in the early days of the institution. There was a cut metal filigree design on the inside of the lid which showed a double-tailed mermaid. This, Jon assured me, was Melusine. The symbol appears again on the Starbucks logo. Look carefully and you’ll see: she’s a crowned princess holding a fish tail in each hand.

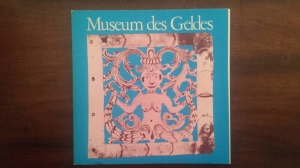

Jon had first seen the image on the front cover of an art catalogue from Düsseldorf dating from 1978, called, in translation, The Museum of Money. He’d written about this in his Money Burner’s Manual. She had also featured in Daisy Campbell’s revue on the 23rd of October, when she’d appeared on a raised platform above the stage: Jacqui Haigh wearing a silver tailed costume she’d designed and made herself, during which she had scattered gold coins and had golden confetti blown out from a gun between her legs.

Quite why Melusine is a symbol of money is more difficult to work out, but we’re in the business of creative iconography here, and Jon was lead to his conclusions by mysterious and magical means, so we’ll leave it be for the moment.

As to why Starbucks would choose a double-tailed mermaid as their symbol (which in its unexpurgated form has decidedly sexual implications) is another matter.

So, anyway, that’s how Jacqui appeared this day, dressed as Melusine, doing her patented Melusine dance beneath the statue of Wellington in front of the Royal Exchange, thus evoking the magical being, thus allowing her space in our collective imagination to weave her spell.

By Christopher Stone

To be continued….